inherited annuity tax calculator

Ad Learn More about How Annuities Work from Fidelity. You should receive a Form 1099R Distributions from Pensions Annuities Retirement or Profit Sharing Plans IRAs Insurance Contracts etc from the payer of the lump.

Annuity Beneficiaries Inheriting An Annuity After Death

This is a problem only for non-spouse.

. People inheriting an annuity owe income tax on the difference between the principal paid into the annuity and the value of the annuity at the annuitants death. Robert will have to withdraw 21097 500000. Qualified annuities are funded with pre-tax dollars while non-qualified annuities are funded with after-tax dollars.

Typically all inheritable qualified annuities usually IRA. Ad Learn More about How Annuities Work from Fidelity. Estate taxes may come into play as well.

The original annuity contract holder must include a death benefit provision and name a beneficiary. If the payout is over an annuitants lifetime and the annuitant outlives life expectancy all further payments. Ad Annuities are often complex retirement investment products.

If the beneficiary is a spouse of the deceased annuitant they can carry on. Tax Rules for Inherited Annuities. If youre the spouse of the.

For each I assume yes part of the distribution was an RMD. A Fixed Annuity Can Provide a Very Secure Tax-Deferred Investment. If a beneficiary takes the money over time no taxes are owed until the annuity is cashed in.

For annuities the key to taxation is how much the deceased person paid to purchase the annuity contract and how much money the deceased person received from the. Helping You Avoid Confusion This Tax Season. Ad Get More Income By Comparing Rates From 31 Top Companies.

When an annuity payment is made 50 of each payment would be income taxable. The RMD is calculated using the Uniform Life Table and the deceased owners age 76 at death in the year of the IRA holders death in 2022. This difference affects many aspects of how the two types of.

Try Our Free Tax Refund Calculator Today. Calculate the required minimum distribution from an inherited IRA. While an inherited annuity can provide an unexpected windfall the tax implications of withdrawing money from it could be costly.

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Taxes on an inherited annuity are usually dictated by your beneficiary status and how you receive payouts. For an annuity with a large untaxed gain that could mean that a lot of the money would go to pay state and federal income taxes.

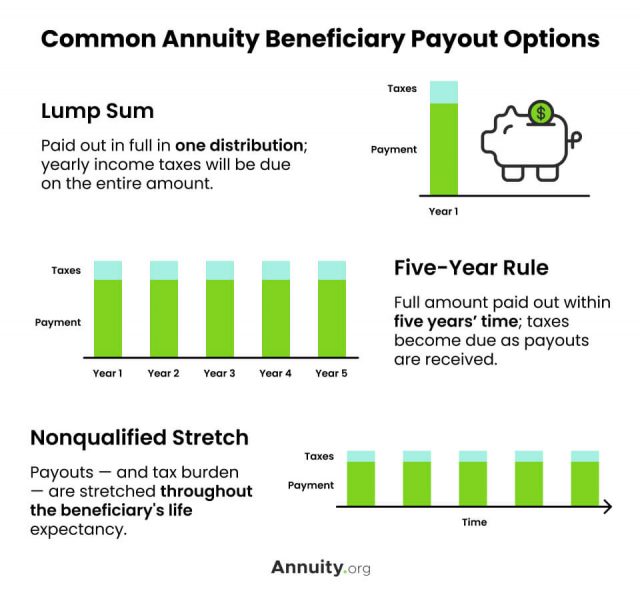

Inherited annuity payouts may follow different tax rules. In general if you withdraw money from your annuity before you turn 59 ½ you may owe a 10 percent penalty on the taxable portion of the withdrawal. I inherited 3 annuities from my father who died in 2014.

Because your wife chose to cash in the annuity a portion of what she received will be income from the invested funds. Learn some startling facts. The earnings are taxable over the life of the payments.

Learn why annuities may not be a prudent investment for 500000 retirement portfolios. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Although you cant completely avoid taxes on.

TurboTax is asking if the withdrawals were RMDs. Learn More on AARP. After that age taking your withdrawal.

Tax rules tax implications tax liability and if you need to pay taxes on the inherited annuity will all come into play. Ad No Matter What Your Tax Situation Is TurboTax Has You Covered. If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from.

How taxes are paid on an. Inherited annuities come with a number of tax implications especially if the inherited beneficiary is a non-spouse. Ad A Calculator To Help You Decide How a Fixed Annuity Might Fit Into Your Retirement Plan.

Fidelity Guaranty Life Safe Income Plus Annuity Review Annuity Income Activities Of Daily Living

2021 Investment Outlook Investing Financial Coach Economic Trends

Annuity Beneficiaries Inheriting An Annuity After Death

How To Avoid Paying Taxes On An Inherited Annuity Smartasset

Offset Taxes On Inherited Iras With This Annuity Annuity Inherited Ira Ira